Sebi's findings indicate that the lack of proper segregation posed potential risks to market integrity and operational efficiency. The regulator's mandate requires that exchanges and their subsidiaries maintain a clear distinction in their operational capabilities to prevent any potential conflicts of interest or compromise in data handling. The imposition of this penalty underscores Sebi's commitment to ensuring that firms uphold the highest standards of operational integrity and transparency.

The inquiry into NSE Data and Analytics began when Sebi received complaints regarding its data management practices. Concerns were raised about the potential misuse of sensitive market information due to inadequate security protocols and shared infrastructure. Upon review, Sebi found that the company had not implemented necessary measures to ensure data security and maintain independent IT systems as stipulated by the regulatory guidelines.

NSE Data and Analytics, established as a subsidiary of the NSE, plays a crucial role in providing data and analytics services to various stakeholders in the financial markets. Its services include market data dissemination, analytics, and technology solutions designed to enhance decision-making for market participants. The absence of proper segregation of IT systems could compromise the confidentiality and integrity of data, thereby affecting the trust placed in the market by investors and other stakeholders.

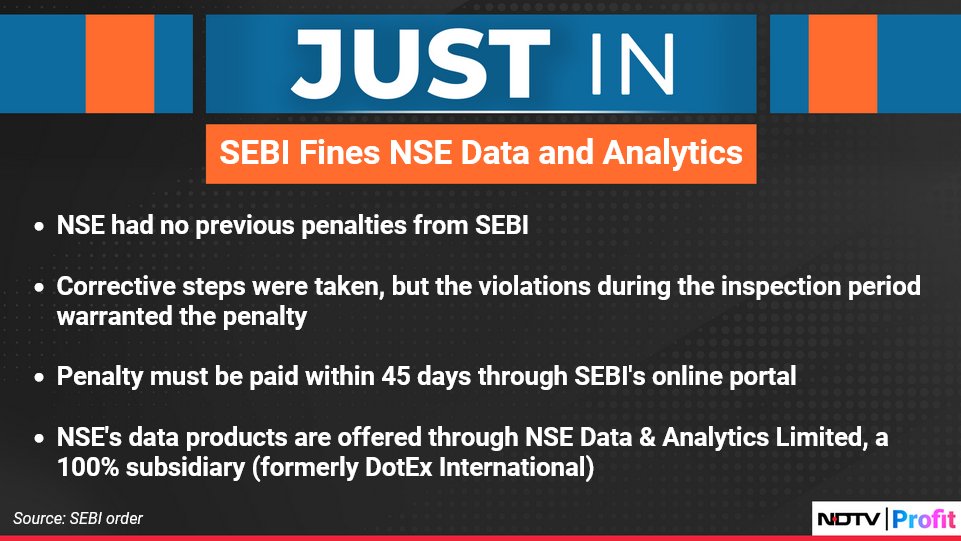

In response to the fine, NSE Data and Analytics has acknowledged the regulator's concerns and expressed its commitment to rectifying the identified issues. The company stated that it is taking immediate steps to comply with Sebi’s directives and to enhance its operational protocols to ensure that its IT infrastructure is adequately segregated. The management has also emphasized its ongoing efforts to improve data security measures and reinforce its IT governance framework.

This incident is part of a broader trend where regulators are increasingly scrutinizing the operations of financial entities, particularly in the wake of rising digitalization in financial services. The demand for data security and operational transparency has never been more critical, as cyber threats and data breaches pose significant risks to market stability. As a result, firms are now under more pressure to comply with strict regulatory requirements aimed at safeguarding market integrity.

Market experts note that this penalty could serve as a warning to other financial entities regarding the importance of compliance with operational guidelines set forth by regulatory bodies. Ensuring the proper segregation of IT infrastructure is not merely a procedural requirement but a foundational aspect of maintaining market trust. Companies that fail to meet these standards risk facing similar penalties, which could impact their reputation and operational capacity.

The fine imposed on NSE Data and Analytics reflects Sebi's broader enforcement strategy, which aims to uphold the highest standards of conduct within the financial markets. The regulator has taken a proactive approach to address potential compliance issues, signaling its intention to foster an environment of accountability and transparency among financial institutions.

Sebi's actions also highlight the evolving landscape of financial regulation in India. With the rapid growth of fintech companies and the increasing reliance on technology for trading and data analysis, regulatory frameworks are being adapted to address the unique challenges posed by these advancements. As such, financial entities are urged to remain vigilant and proactive in aligning their operations with regulatory expectations.

As the market continues to evolve, the demand for robust data analytics capabilities is set to grow. Companies that can effectively leverage data while ensuring compliance with regulatory standards will likely gain a competitive edge in the marketplace. This emphasizes the need for firms to invest in technology and processes that not only enhance operational efficiency but also adhere to the guidelines set by regulators like Sebi.

Industry analysts suggest that NSE Data and Analytics must not only address the immediate concerns raised by Sebi but also look at long-term strategies to strengthen its governance and compliance frameworks. This includes regular audits, employee training on regulatory compliance, and the establishment of independent oversight mechanisms to monitor adherence to operational standards.